Here’s a good business rule to follow: buy low and sell high.

That’s good, but the three-step process below is even better:

- Buy low.

- Depreciate to zero.

- Sell high.

And you can accomplish this by using antiques in your business.

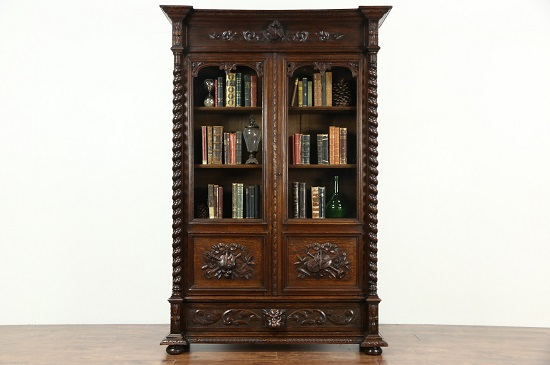

If you can buy an antique car, clock, rug, desk, cabinet, bookcase, paperweight, conference table, chair, umbrella stand, coatrack, library table, or other asset that will function in your business just as well as a new purchase, take the antique that might increase in value. It simply adds to your net worth.

How many business assets have you bought and used in your business that have gone up in value?

If you are like most businesspeople, the answer to this question is “none” or “very few.” In fact, you may not have considered antiques at all.

But now that you know their business potential, give antiques a serious look. With antiques, you can get the best of all worlds:

- beautiful assets you use in your business,

- assets you can depreciate and/or Section 179 expense against your business income, and

- assets that can increase in value.

If you were to buy antiques for your business today, you could expense up to $500,000 of qualifying costs using Section 179 expensing.

We are closing in on the end of the year. Are you looking for some last-minute deductions? Consider antiques!

If you have questions about the antique strategy for your business, don’t hesitate to call us at 714-896-0366.